Upcoming Lighter TGE: What Is a Reasonable Valuation? As a finance and blockchain translation expert, you are familiar with the field's slang and terminology.

Original Article Title: A simple Lighter valuation framework (Bear/Base/Bull)

Original Article Author: @chuk_xyz

Translation: Peggy, BlockBeats

Editor's Note: As Lighter is about to undergo its TGE, the market's divergence on its valuation stems not from emotion, but from different understandings of its product positioning and growth trajectory. Is it merely another perpetual contract exchange, or is it a trading infrastructure with the potential to support a larger distribution and asset form? The answer determines the valuation ceiling.

This article attempts to break out of the lazy framework of "simple benchmarking" and return to the more verifiable facts themselves: the actual TVL and trading volume scale, proven revenue-generating capabilities, a first-mover advantage on the RWA track, and a product expansion roadmap leading to 2026. Based on this foundation, the author provides a valuation range division that does not rely on emotion, using "zone bands" rather than a "target price" to address uncertainty.

The following is the original text:

As Lighter's TGE approaches, the market's opinion on "how much it is really worth" has shown a clear division.

On the one hand, some people simply classify it as "yet another perpetual contract exchange," believing that it will be challenging for it to beat Hyperliquid in the competition; but on the other hand, some real market signals have emerged, indicating its scale and potential impact may go far beyond just a regular Perp DEX launch.

TL;DR: The current market's pricing of Lighter still mainly centers around the low single-digit billion-dollar FDV range; however, if the fundamentals continue to deliver, and key catalysts are sequentially implemented, its reasonable revaluation range may be closer to $60 billion-$125 billion, or even higher.

Disclosure: I am an early user of Lighter (644.3 points) and will likely receive an airdrop. This article represents only personal research and opinions and does not constitute any investment advice.

My Lighter Points

In my opinion, the current situation is roughly as follows: Based on trading on Polymarket, the implied valuation given to Lighter is approximately between $20 billion and $30 billion (at least based on current price signals being traded).

In the Over-the-Counter (OTC) market, Lighter's point trading price is approximately around $90; based on a calculation of about 11.7 million points, the corresponding airdrop value is approximately $1.05 billion.

If this airdrop accounts for about 25% of the total token supply, then extrapolating upwards, Lighter's fully diluted valuation (FDV) is approximately around $4.2 billion.

Previously, Lighter raised $68 million, with a valuation of about $1.5 billion, led by Founders Fund and Ribbit (as reported by Fortune).

Founders Fund has a long and prominent track record in early-stage bets on category-defining companies, having previously invested in iconic enterprises such as Facebook, SpaceX, Palantir, Stripe, and Airbnb.

Additionally, the pre-market pricing of $LIT roughly corresponds to an FDV of about $3.5 billion, a price that can be seen as a real-time market reference signal (although still in the early stages and not entirely precise).

Therefore, my framework for assessing it is quite simple: $15 billion can be considered the lower valuation limit (leaning bearish, anchored by VC funding round pricing). The range of $30 billion to $42 billion falls within the bearish to benchmark range (predictions from the market, pre-market pricing, and the point-based extrapolated valuation largely converge here).

The real core question is: based on fundamentals and catalysts, whether Lighter deserves a reassessment to the range of $60 billion to $125 billion or even higher.

The purpose of this analysis is precisely to try to logically explain these issues: What exactly is Lighter's product, what signals are being released at the data level, which valuation frameworks are reasonable, and which catalysts might drive it further up for reassessment.

1. A Key Misunderstanding: Lighter and Hyperliquid Are Not the Same Type of Product

The clearest mental model I have found so far is:

Hyperliquid is building a Web3-native liquidity layer, with its main monetization coming from retail transaction fees (and overlaying network effects at the ecosystem level).

Lighter is building a decentralized trading infrastructure, with the long-term goal of onboarding FinTech companies, brokerages, and professional market makers, while reducing execution costs to an extremely low level on the retail side (some spot markets even achieving 0% transaction fees).

From this perspective, the problems they are solving, the customer base they are serving, and their long-term business trajectory are fundamentally different.

Business Model of Lighter vs Hyperliquid Source: @eugene_bulltime

This distinction is important because it directly determines where the valuation ceiling lies.

If Lighter is simply "another perpetual contract exchange," then it would be priced similarly to other Perp DEXs, which is not surprising logically; but if it is essentially a trading infrastructure that can be accessed by large distribution channels (brokerages / FinTech companies), then the valuation ceiling it faces is a whole different set of rules.

2. Lighter's Current Position (Critical Data)

Let's start by looking at the most critical set of metrics:

TVL: $14.4 billion

LLP TVL: $6.98 billion (Lighter's Liquidity Pool, used for trade execution and system stability)

Open Interest: $17 billion

Volume (24 hours): $54.1 billion / (7 days): $444 billion / (30 days): $2.483 trillion

Revenue: Last 30 Days: Approximately $13.8 Million / Last 1 Year: Approximately $167.9 Million

The "feel" conveyed by these numbers is important in itself: this is already a significant scale. A monthly trading volume of $248 billion is definitely not a "playful" exchange.

The Open Interest (OI) is substantial but not so high as to cause systemic chaos from a single extreme liquidation event.

The TVL is high enough to allow Lighter to reasonably position itself as a venue for large transactions with stability — and reliability is indeed one of the core factors that institutions value most.

Risk-Reward Ratios Check: OI / TVL (Open Interest / Total Value Locked)

A quick way to measure the leverage level and liquidity match is to calculate OI/TVL (Open Interest divided by TVL). Based on the current snapshot data:

Lighter: 1.71B / 1.44B ≈ 1.18

Hyperliquid: 7.29B / 4.01B ≈ 1.82

Aster: 2.48B / 1.29B ≈ 1.92

Intuitively, Lighter's OI/TVL is significantly lower, indicating that it has more adequate liquidity buffer at a relatively controllable leverage level. This structure does not pursue maximum efficiency but leans more towards robust execution and system resilience — aligning with its positioning as an "infrastructure-type trading system."

Key Takeaway: Lighter already has a significant scale of open interest contracts, but compared to its liquidity level, it is not overly stretched overall; compared to the closest top-tier products in its class, its risk structure is more restrained and robust.

3. Spot Market: Key Unlocking to Further Increase TVL

Lighter recently launched spot trading, a point that the market may have significantly underestimated.

Perpetual contracts can indeed generate huge trading volumes, but what truly tends to retain "sticky funds" is often the spot market — especially when a trading platform has a clear advantage in execution efficiency and cost.

At the same time, spot trading has significantly expanded the potential user base: for new users, spot trading is a lower barrier to entry; for market makers, spot trading provides more reasons to hold and allocate inventory on the platform.

Currently, ETH is the only spot asset that has been listed. This is not a limitation, but a starting point. The truly noteworthy signal is this: the "track" of spot trading has already been laid, and the product itself has the structural foundation to smoothly expand as more assets are listed.

Lighter Spot Token Value Chart (WETH) (Source: DeFiLlama)

Even though only ETH is currently listed, data from DeFiLlama shows that the Lighter spot side has already accumulated around $32.33 million worth of WETH (snapshot time: 12/18/2025).

This is still in the early stages, but the signal is clear: funds have already started "parking" on the spot side.

If Lighter follows the publicly hinted-at path, gradually introducing dozens (or even eventually hundreds) of spot assets, then spot trading will become a substantial driver of TVL growth, rather than just a "cherry on top" feature module.

More importantly, ETH spot 0% fees are a strong incentive in themselves. As long as execution quality remains stable (narrow spreads, reliable execution), it will naturally attract active traders and institutions to route high-frequency strategies and spot-perpetual basis trading to Lighter. The result is very straightforward: more trading → more inventory → deeper liquidity, forming a self-reinforcing positive feedback loop.

The conclusion is clear: spot listing is a significant milestone. ETH is just the first step, and the true upside potential comes after the expansion of the spot asset catalog, gradually transforming the platform into the default venue for on-chain "trading + holding."

4. RWA: Unlocking Point in 2026 (and Why Lighter Is Already Ahead)

One of the clearest signals that Lighter is not "just another Perp DEX" comes from RWA (Real World Assets).

RWA (tokenized stocks, foreign exchange, commodities, indices, etc.) is essentially a bridge between crypto trading and the traditional market. If by 2026, tokenized assets continue to migrate to the blockchain, then the first platform to capture RWA will gain not only more trading volume but also a growth curve that most Perp DEXs are not yet prepared for.

The key is not in the narrative, but in the scoreboard. And from the data, Lighter is already ahead.

RWA Leadership: Let the Data Speak

Lighter is already leading in two key metrics related to on-chain RWA perpetual contract: Open Interest (OI) and Trading Volume. This combination is crucial:

OI reflects the scale of exposure that traders hold long term;

Trading Volume reflects the intensity of daily usage and activity.

When an exchange leads in both metrics, it usually means that traders are not just "dipping their toes" but have already made it a primary stronghold for that product line.

This is also why RWA seems more like a structural opportunity for Lighter: it is not chasing a fad but rather positioning itself early in a market that is about to scale up.

RWA Open Interest: Lighter Leading the Race (Source: PerpetualPulse.xyz)

In the current snapshot, the approximate open interest size for RWA perpetual contracts is:

Lighter: about $273 million

Hyperliquid: about $249 million

The significance of this gap lies in the fact that RWA is still in its early stages. In early markets, liquidity often exhibits highly concentrated characteristics:

When a trading venue first accumulates scaled liquidity, spreads tighten, trade quality improves, and a better execution experience, in turn, attracts more funds and trading volume, creating a self-reinforcing positive feedback loop.

From this perspective, Lighter's leadership in RWA OI is not just a one-time static ranking but more like the starting point of a potential compounding effect.

RWA Trading Volume: Lighter Also Leads in Activity (Source: PerpetualPulse.xyz)

From the perspective of trading volume, this trend is even more clear:

Lighter: approximately $4.84 billion

Hyperliquid: approximately $3.27 billion

This is a typical form of Product-Market Fit (PMF) in its early stages: a new category is beginning to take shape, and a particular exchange is the first to capture a disproportionate share of trading activity. As usage frequency and execution experience continue to accumulate on the same platform, the first-mover advantage is often further amplified.

Market Size Underestimated

It's worth taking a broader view: tokenized Real-World Assets (RWA) are not a niche track. On the public blockchain, it is already a multi-billion dollar market, and the growth curve continues upward.

This means that establishing liquidity, execution quality, and user habits early not only wins the current trading volume but also secures a long-term growth trajectory that is still expanding.

"Global Market Overview" Dashboard (Source: rwa.xyz)

The scale of tokenized RWA on the public blockchain has already exceeded approximately $18.9 billion and is still in its early stages.

The importance of this is that RWA is one of the few narratives in the crypto space that does not need to "fight for attention": it can expand outward, bringing real-world assets and transactions onto the chain, making a direct incremental impact instead of getting caught up in internal cycles.

Why This Is a Significant Valuation Catalyst

RWA perpetual contracts have already validated real demand; but the larger unlocking point lies in the next step: RWA spot.

Perpetual contracts excel at speculation;

Spot is the key to expanding the user base.

If Lighter can become one of the first to provide trusted RWA spot trading on-chain (tokenized stocks/forex/commodities) while maintaining strong execution quality and institutional-grade reliability, it would not just be adding a feature but significantly expanding the Total Addressable Market (TAM) it can serve.

This also directly aligns with the narrative of Robinhood: once tokenized stocks become a true product distribution channel, the value of the "backend exchange/infrastructure layer" will significantly increase—because in the trading space, distribution capability is the most challenging moat to build.

The Roadmap Supporting This Direction

From the product roadmap perspective, Lighter is clearly aiming towards 2026: a deeper RWA expansion and the complementary capabilities needed to support its scalability (mobile-first, portfolio margin, prediction markets, etc.).

This is not a one-time narrative but a continuously amplifying product curve.

Chainlink × Lighter Seoul Offline Event '2026 – Expansion' Roadmap Slide

If RWA is one of the key themes of 2026, then entering early and already leading in OI and volume is a very strong start in itself.

The conclusion is clear: RWA is not a "side quest" for Lighter. Instead, it is more like the most distinct path to achieving exponential growth in 2026–2027, as this path will transform Lighter from a pure crypto-native perpetual contract market to a broader world of tokenized financial products.

5. Robinhood Alignment Narrative: Why "Distribution" Will Change Everything

Robinhood is currently the cleanest and most imaginative distribution wedge on the desktop: about 26 million funded accounts and around $333 billion in assets under management (AUM)

Matured pattern: routing order flow to large market makers (typical Citadel-style flow structure)

Once Robinhood becomes a real distribution channel for tokenized assets, the backend trading infrastructure that provides execution and settlement rails will become extremely valuable—because in the trading realm, distribution capability has always been the hardest moat to build.

If Lighter can become one of the backend rails for tokenized assets/perpetual contracts/clearing-class flow (even if only in part), its impact won't be "more crypto users," but rather: introducing entirely new liquidity into the on-chain market through a familiar front-end UI.

The significance for valuation is that it directly addresses the biggest ceiling most Perp DEXs face: Web3-native liquidity is substantial but still limited compared to the distribution capacity of traditional finance.

However, the market often does not wait for all the dust to settle. Even if this narrative is only "likely to go mainstream," it is enough to trigger repricing—because the pricing of the crypto market is based on probability, not certainty itself.

Lighter's "TradFi & Fintech" Infrastructure Positioning (Source: X @Eugene_Bulltime)

6. Valuation: A Simplified Framework Not Based on "Belief"

I prefer to use an anchor + reality check for valuation.

Valuation Anchor (Information Already Provided by the Market)

$1.5 billion FDV: Lower Limit / Bear Market Anchor (from a $68 million VC pricing round). Falling below this level implies that the funding round has been at an unrealized loss from the start.

Approximately $4.2 billion FDV: Market Implied Anchor (OTC point pricing + reverse-engineering of ~25% community quota).

Reality Check #1: FDV / TVL Comparison

If Lighter is priced at ~5× TVL: 1.44B TVL × 5 ≈ $7.2 billion FDV

This is not a wild guess but aligns with the clustered range of similar platforms:

Hyperliquid: ~5.8× FDV/TVL

Aster: ~4.2× FDV/TVL

Therefore, as long as the TVL can be sustained, and Lighter continues to prove its leading position in trading volume and OI, a $7–8 billion FDV is a reasonable "fair value" range.

Reality Check #2: Revenue Comparison (Imperfect but Critical)

Revenue is not the only valuation method in crypto (narrative is equally important), but it is one of the hardest real-world anchors that can test if "usage has truly turned into cash flow."

Annualized Revenue (1y) Estimate:

Hyperliquid: ~$9 billion

Aster: ~$5.13 Billion

Lighter: ~$1.679 Billion

dYdX: ~$10.9 Million

Two conclusions can coexist at the same time: the income gap is indeed real. Lighter's current income is lower than Hyperliquid and Aster, which is a reasonable reason the market discounts it today. If someone were to directly price Lighter as the "next Hyperliquid," income is the most direct counterpoint.

As a platform with unreleased tokens and products still in the early stages, this income is still very solid. An annualized ~$1.68 billion is not "common." It does not automatically prove a higher FDV immediately reasonable, but it clearly indicates: Lighter is not running on hype but is running a real, monetizable business.

Where Does the Valuation Range Fall?

Bear/Base Case ($15–75 Billion FDV):

As long as TVL holds steady and continues to prove its leading position in terms of volume/OI, even with an income gap, this range holds.

Bull Market ($75–$125 Billion+ FDV):

Catalysts are needed to become consensus, including:

(a) faster income growth;

(b) higher and sustainable activity; or

(c) the market willing to price in mainstream distribution narratives in advance.

One-sentence summary: Income is the "proof-of-work." It puts pressure on short-term multiples but is also a strong signal that Lighter already has real traction; upside depends on whether income growth significantly accelerates after product expansion on the surface.

7. Scenario Assumptions (Truly "Makes Sense" FDV Ranges)

Bear Market Scenario: $15–42 Billion FDV

Assumption: Weak market + TGE selling pressure + narrative gap. Price revolves around VC floor or slightly above implied value.

Base Case Scenario: $42–75 Billion FDV

Assumption: Pricing returns to fundamentals. TVL stays above $10 billion, volume/OI remains at the top, priced based on comparable multiples.

Bull Market Scenario: $75–$125 Billion+ FDV

Assumption: Catalysts form consensus, including:

RWA momentum sustains + clear RWA on-chain path; and/or

The Robinhood-style distribution narrative has been widely embraced (albeit not fully confirmed yet).

8. Roadmap Signal: Why 2026 Could Be the Year of True Expansion

Combining product cadence with the narrative trajectory, 2026 looks more like a key year in Lighter's amplification curve:

RWA Deepening, Spot Expansion, Mobile End and Portfolio Margin complementary enhancements—these are not isolated features but point towards the same direction of greater distribution and higher monetization efficiency.

Lighter 2026 Expansion Roadmap (Seoul Offline Event Slide)

Lighter had already shown remarkable traction in 2025, but what truly changes the valuation ceiling is what's about to unfold next.

At the Chainlink × Lighter Seoul Meetup, a roadmap labeled "2026 – Expansion" leaked, including:

ZK EVM, RWA Perps, RWA Spot, Portfolio Margin, Mobile App, Prediction Markets, S3 / Tokenomics… and more

Even if seen as "informal information prior to official confirmation," when you connect it with Lighter's already verified capabilities—stable execution, rapid delivery, and clear momentum in RWA—this roadmap is highly internally consistent.

Why This Roadmap Is Crucial for Valuation

1) Expand the Product Surface (More growth paths for TVL and volume)

Expanding a DEX with only perpetual futures can make it big; but adding spot, especially the path to RWA spot, significantly widens the funnel.

Spot is stickier, more conducive to TVL sedimentation, and will attract a class of users not centered around 50x leverage.

2) Improve Capital Efficiency (Portfolio Margin is key)

Combination Margin may not sound sexy, but it's what institutions and professional traders truly care about.

It enables funds to work together across different positions, reducing fragmentation and increasing activity without proportionally increasing new deposits.

3) Upgrade Distribution (Mobile)

Most retail trading happens on mobile.

If Lighter aims to be a viable alternative to "one-click trade" experiences like Binance and Robinhood, native mobile is not a nice-to-have but a direct growth lever.

4) Double Down on Strongest Narrative (RWA)

RWA is not just a new market; it's a clear bridge to non-crypto native demand.

The roadmap clearly states RWA Perps + RWA Spot, signaling: this is core strategy, not a side feature.

5) Enhance Opt-in (Prediction Markets + "More")

Prediction markets have validated demand within crypto.

If integrated into a broader trading stack, it can create a highly engaging product line, improve retention, and keep users within the same ecosystem.

9. Risks That Demand Serious Attention

Market Environment: Current crypto total market cap is around $2.96 trillion, significantly below the $4.27 trillion ATH in October 2025. If the macro environment continues to weaken, all assets will be under pressure.

Post-TGE Behavior: Short-term selling pressure is almost certain; a key observation point is whether TVL/trading volume stabilizes after the initial volatility.

Real Competition: Hyperliquid has strong product capabilities, and other platforms will quickly replicate features.

Narrative vs. Validation: Narratives like Robinhood/RWA Spot, if prolonged, may experience overheated retracements.

Closing Thoughts

A lazy valuation approach would be: "It's a Perp DEX → Benchmark against Hyperliquid → Apply a discount → Done."

A better approach is to acknowledge these differences:

Scale is already real (TVL, trading volume, revenue).

RWA appears to be a structural wedge, not a side task.

The product direction is aimed at a broader market (Perps → Spot → Margin → New Vertical).

Once fintech/brokerage distribution touches even a part of the ground, the ceiling is no longer just "another crypto exchange."

Therefore, my framework is: $1.5 billion is the bottom, ~$4.2 billion is the cleanest market anchor point reverse-engineered from the fully diluted valuation (FDV); as long as the TVL holds, catalysis continues to materialize, the discussion of fair value should start from above ~$7 billion.

How I'm thinking about the zones (not financial advice, solely for personal planning)

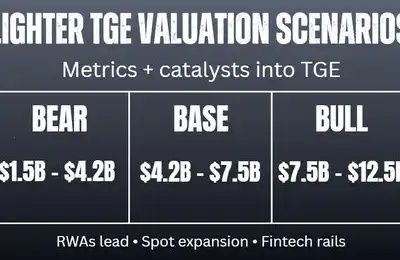

$LIT Valuation Scenario Analysis

To keep myself disciplined, I treat these FDV ranges as "zones" rather than exact price targets.

Bear Market Zone ($1.5 billion–$4.2 billion FDV)

If post-TGE price oscillates in this range, I see it as an "opportunity zone."

Here, holding the airdrop, my psychological stress is minimal; and for those who truly buy into this logic, this is also the cleanest risk-reward ratio area—because TVL, trading volume, and RWA traction are already visible and verifiable facts.

Baseline Zone ($4.2 billion–$7.5 billion FDV)

If Lighter can sustain TVL and continue to operate at a top-tier scale, I will consider this range as fair value.

If the price runs into this area, I would personally consider partial profit-taking ("getting the cost back first"), but still maintain exposure. The reason is simple: the 2026 roadmap is the type of configuration that can progressively raise the valuation ceiling—including RWA, spot expansion, portfolio margin, mobile, etc.

Bull Market Zone ($7.5 billion–$12.5 billion+ FDV)

This is where "catalysts have become consensus."

If Lighter trades into this territory, it often signifies that RWA momentum is impossible to ignore, and/or the distribution narrative (fintech/brokerage alignment) is starting to be taken seriously by the market.

In this scenario, I would be more proactive in taking risks on the upside, as this is where the crypto market is prone to overshoot and quick reversals.

One-Sentence Summary: I'm not trying to catch the top. I just want a strategy that allows me to navigate through volatility, take profits without regrets, and still keep my exposure intact by the time Lighter successfully launches in 2026.

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia