Key Market Insights from December 19th, How Much Did You Miss Out?

Featured News

1. Base App Fully Opens with Over 12,000 New Users on Opening Day, Setting a New Daily Record

2. Solana Ecosystem Meme Coin JELLYJELLY Continues to Surge, with a Approximately 40% 24-hour Gain

4. Japan Implements Rate Hike, Well-Known Traders and Analysts Unanimously Bullish

5. RateX Unveils RTX Tokenomics, with 44.18% Allocated to Ecosystem and Community

Featured Articles

1. "UNI Burn Proposal Vote, Lighter TGE Expectations, Overview of Mainstream Ecosystem Trends"

Over the past 24 hours, the crypto market has unfolded on multiple fronts. Mainstream discussions have centered around the release schedule and buyback strategy of the Perp DEX project, ongoing debates on the timing expectations of Lighter's TGE and whether Hyperliquid's buyback is squeezing long-term development. In terms of ecosystem development, the Solana ecosystem has seen real-world attempts of DePIN, while Ethereum is advancing DEX fee structure changes and AI protocol layer upgrades in synchronization. Stablecoins and high-performance infrastructure are accelerating integration with traditional finance.

2. "The Catfish Effect? Stablecoins Are Not Really Enemies of Bank Deposits"

Whether stablecoins will disrupt the banking system was one of the most central debates in the past few years. However, as data, research, and regulatory frameworks have gradually become clearer, the answer is becoming more sober: stablecoins have not sparked massive deposit outflows. Instead, under the real-world constraints of "deposit stickiness," they have become a competitive force driving banks to improve interest rates and efficiency. This article starts from a banking perspective to redefine stablecoins. They may not necessarily be a threat but are more likely a catalyst forcing the financial system to self-renew.

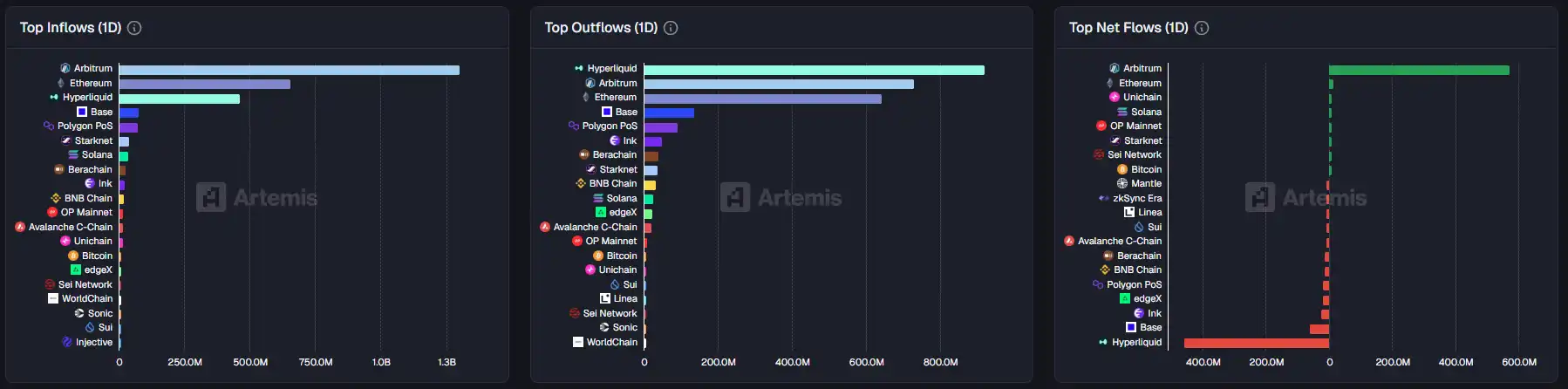

On-chain Data

On-chain fund flow on December 19th

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia