What's the Overseas Crypto Community Talking About Today?

Publication Date: December 12, 2025

Author: BlockBeats Editorial Team

Over the past 24 hours, the crypto market has witnessed a variety of dynamics ranging from macroeconomic discussions to ecosystem-specific developments. The mainstream topics have focused on the significant announcements and project updates from the Solana Breakpoint conference, the ADL controversy, Polymarket's on-chain trading volume reaching a new all-time high, and discussions about the future of crypto debit cards. In terms of ecosystem development, both Solana and Ethereum have seen important updates, showcasing the industry's rapid innovation and expansion. This report will provide a summary of these hot topics.

1. Mainstream Topics

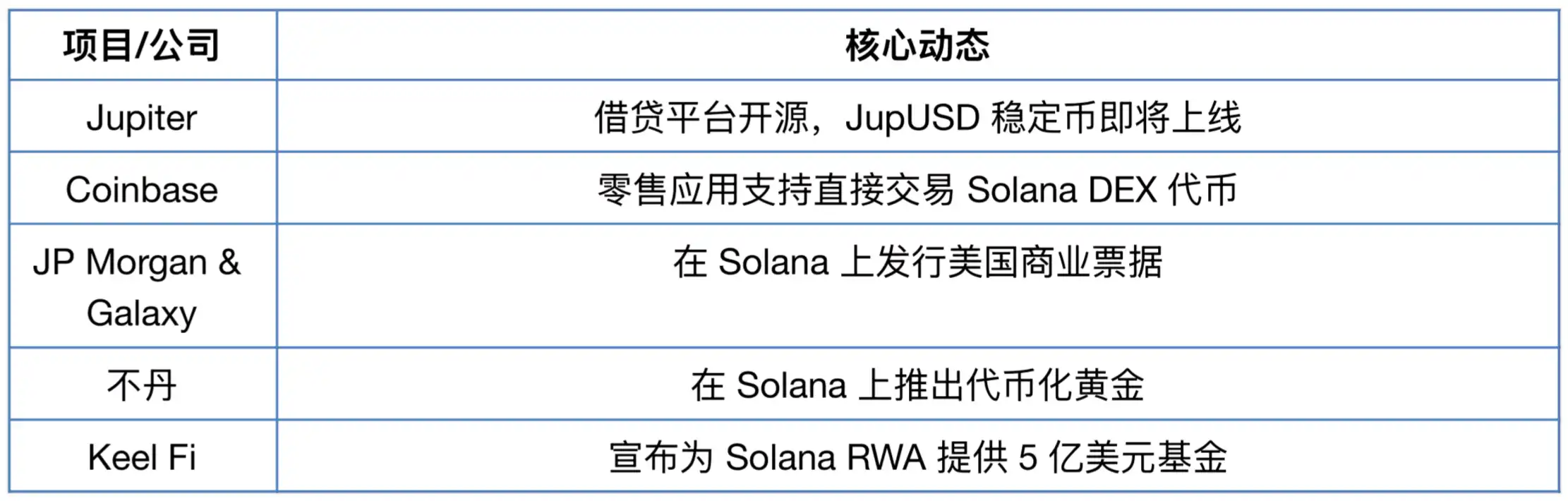

1. Solana Breakpoint: The conference released a series of major announcements that sparked widespread community discussions. Among them, Jupiter announced that its lending platform will be fully open-sourced, its stablecoin JupUSD will go live next week, and the new Jupiter Terminal is now operational. In addition, Coinbase's retail app will now allow users to directly purchase and trade any Solana DEX token using a debit card, bank account, or USDC, significantly enhancing liquidity in the Solana ecosystem. JP Morgan and Galaxy also announced a partnership to issue U.S. commercial paper on Solana, while Bhutan plans to launch tokenized gold on Solana. These initiatives are seen as significant milestones for institutional adoption and real-world asset (RWA) on-chain.

2. ADL (Automatic Deleveraging) Controversy: The discussion within the community regarding the Automatic Deleveraging (ADL) mechanism continues. Some experts believe that there is a lot of misunderstanding about the role of ADL on exchanges. ADL is a crucial part of any margin trading system, aimed at preventing users from continuously losing and addressing insolvency. It combines the concepts of "liquidation" and "profit erosion" from traditional finance. A well-designed ADL system should systematically de-risk high-leverage users first and prevent malicious attacks through the mechanism. While the current design of ADL is not perfect, its presence is essential for maintaining the stability of exchanges.

3. Polymarket On-Chain Trading Volume Hits All-Time High: The on-chain trading volume of the prediction market platform Polymarket has reached a new all-time high, with a weekly trading volume of $1.3 billion, surpassing even the peak during the 2024 U.S. election. The total value on the platform (outstanding contracts / total locked value + USDC balance) has reached $517 million, nearly tripling since the beginning of 2025. Additionally, Polymarket saw 19.9 million website visits in November, marking a new high for 2025, and its U.S. app version briefly topped the sports app charts during the beta phase. These data indicate a sharp increase in user engagement and market interest in prediction markets.

4. Blockworks Lightspeed Investor Relations Platform: The industry's first investor relations platform built for the Solana ecosystem, designed to enhance institutional investors' participation experience

5. The Future of Cryptocurrency Debit Cards article provides a detailed summary of Pavel Paramonov's in-depth analysis on why cryptocurrency debit cards have no future, including his criticism of issues such as reliance on payment processors, KYC requirements, etc.

II. Mainstream Ecosystem Updates

1. Solana:

Ellipsis Labs Phoenix Perpetuals - A layer-one perpetual exchange launched on Solana, considered one of the most significant announcements at the conference. The Toby project announced the launch of the $TOBY token at the Breakpoint conference, aiming to bring base layer yield to Solana through OpenMEV. The OpenMEV initiative aims to service the real yield demands of a $100 billion ecosystem and will be integrated into multiple mainstream protocols such as Jupiter, Sanctum, Kamino, and Drift.

2. Ethereum:

Fusaka Upgrade and L2 Scalability: Discussions focus on Ethereum's Fusaka upgrade, including an 8x L2 capacity increase brought by PeerDAS, gas limit increases, and the security implications for DeFi and institutional applications, emphasizing security and expansion rather than just speed.

Aave V4 Liquidation Engine, Ecosystem Integration, and Growth: Focus on Aave V4's new liquidation engine, including improvements over V3, experience handling over $33 billion in liquidations, and how to enhance protocol security and efficiency, emphasizing default protection and technical optimization. Additionally, Aave's integrations with Arbitrum, Tangem, Babylon, etc., driving BTC native collateral, yield strategies, and incentive mechanisms.

3. Perp DEX:

The Perpetual Decentralized Exchange (Perp DEX) space is also full of energy. The Lighter DEX has garnered attention due to its highly attractive valuation, with analysts believing it to be severely undervalued compared to other Perp DEXes. In recognition of its potential, the renowned trader hyena on Hyperliquid has spent nearly $30,000 to purchase the $LIT Ticker. Furthermore, Hyperliquid itself has introduced a new "Reverse Mode" feature, allowing users to liquidate and open a position in the opposite direction with a single click, enhancing trading efficiency and effectiveness.

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia