Pacifica Transaction Tutorial: Weekly 10 Million Point Reward, How Beginners Can Seize Early Bonuses

Source: Crypto Newbie

The rise of Perp DEX is unstoppable. Following Hyperliquid's pioneering market dominance, a batch of emerging decentralized exchanges has also emerged. This year, Aster, backed by CZ and Yzi Labs, went live and started a trading competition, with its trading volume surpassing Hyperliquid at one point. Equally noteworthy is Pacifica, founded in January this year by three founders including former FTX COO Constance Wang— the project has progressed rapidly, going live on the testnet in just two months and officially launching its mainnet on June 10.

Currently, Pacifica has 30,000 active users, with a seven-day trading volume of up to $59 billion. Despite Pacifica's rapid development, there is still significant room for growth in trading volume compared to current leaders like Lighter and Hyperliquid. Additionally, starting from October 30, the platform's loyalty point issuance has increased to 20 times its original amount, with the current total supply of loyalty points exceeding 135 million. For Pacifica, which has not yet issued its own coin, the attractiveness of the loyalty point program to users is self-evident.

This article has compiled a registration and trading guide for Pacifica. The loyalty point program was launched less than six months ago and is still in its early stages. If you also wish to participate in this loyalty point extravaganza, keep reading.

Pacifica Registration Tutorial

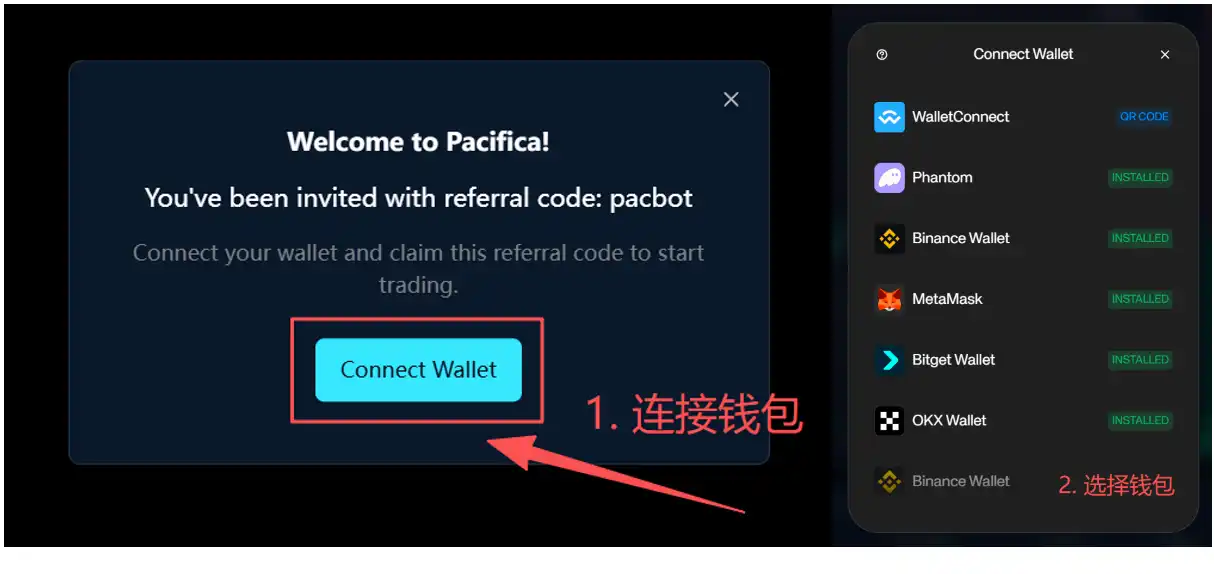

1. Open the Pacifica website and complete registration and wallet linking

Pacifica Website: https://app.pacifica.fi/

After linking the wallet, there will be 2-3 confirmation steps. Follow the prompts to confirm.

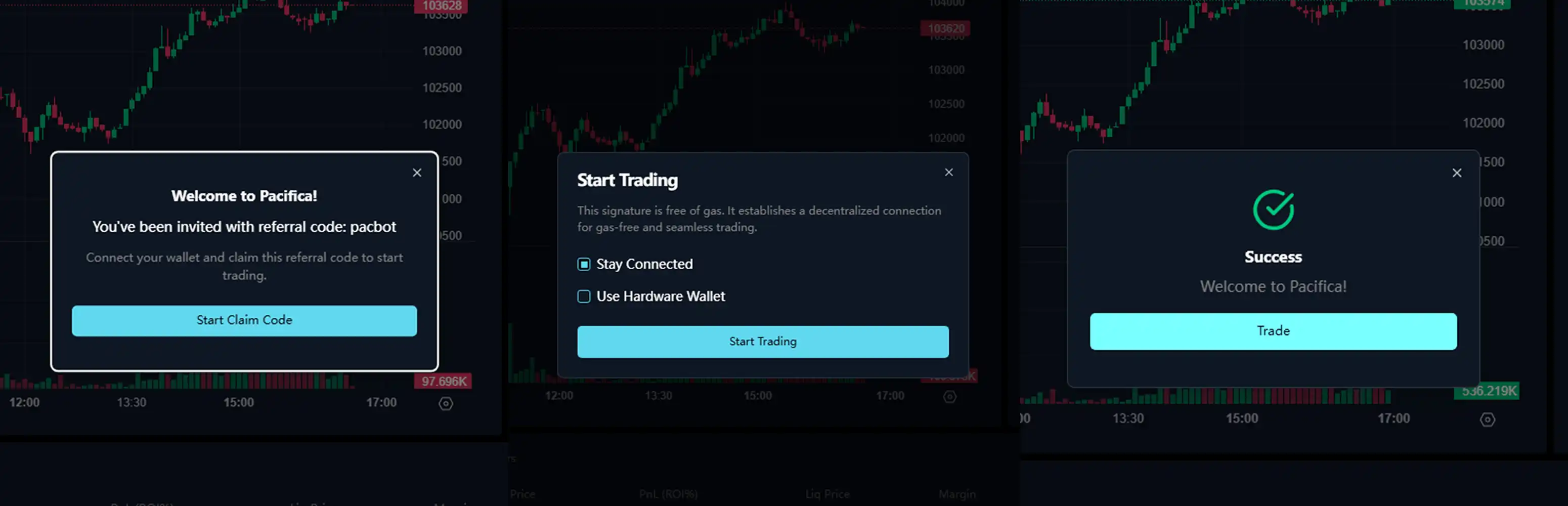

2. Set Language

Currently, the website supports multiple languages. If you are a Chinese-speaking user, click on "Chinese" or "Traditional Chinese"; if you prefer an English page, you can continue without making any changes.

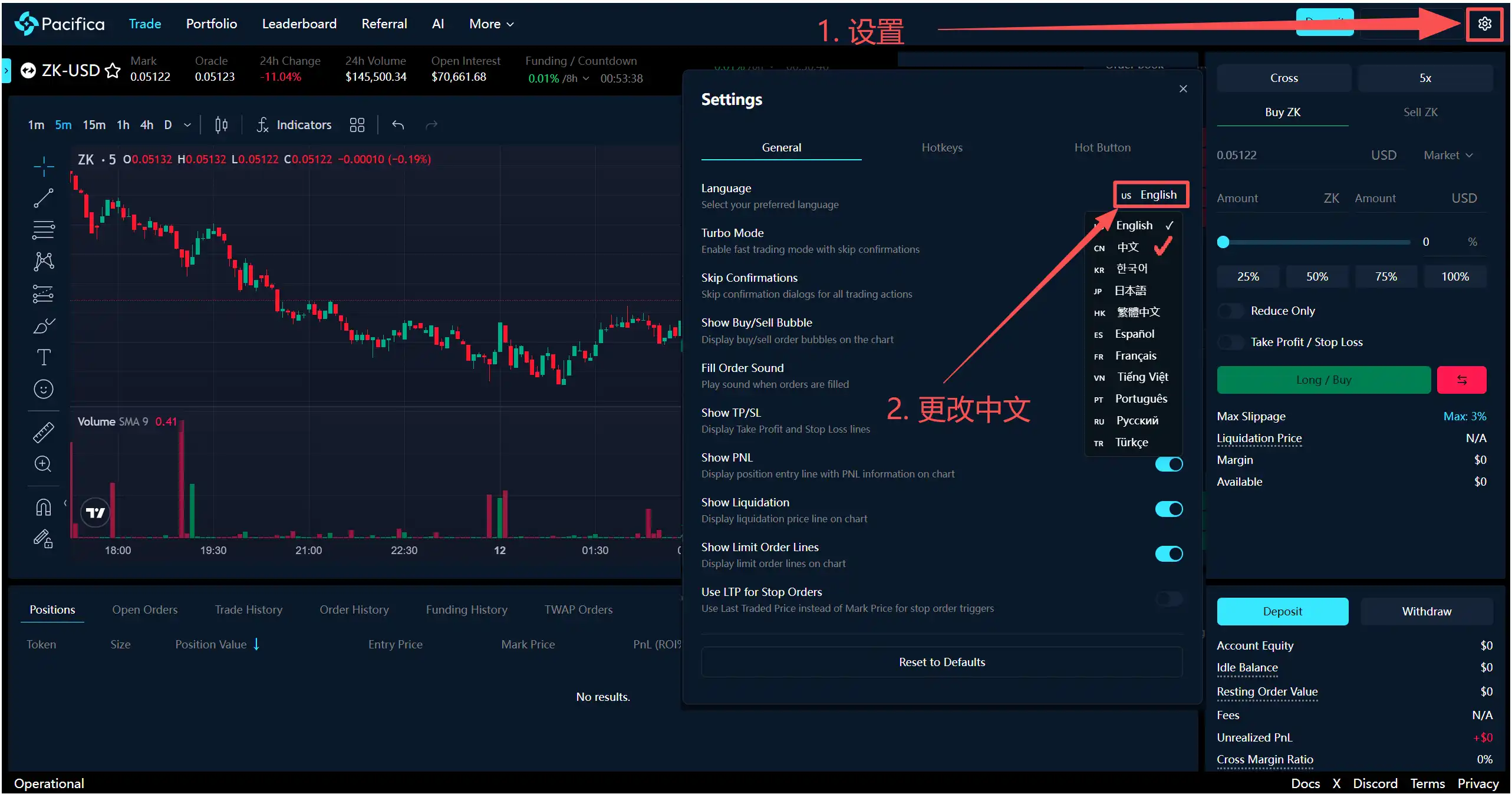

3. Deposit Funds as USDC and Select the Desired Trading Pair

Pacifica is built on Solana, so when depositing funds, you need to choose Solana-based USDC and double-check the wallet address for on-chain transfers.

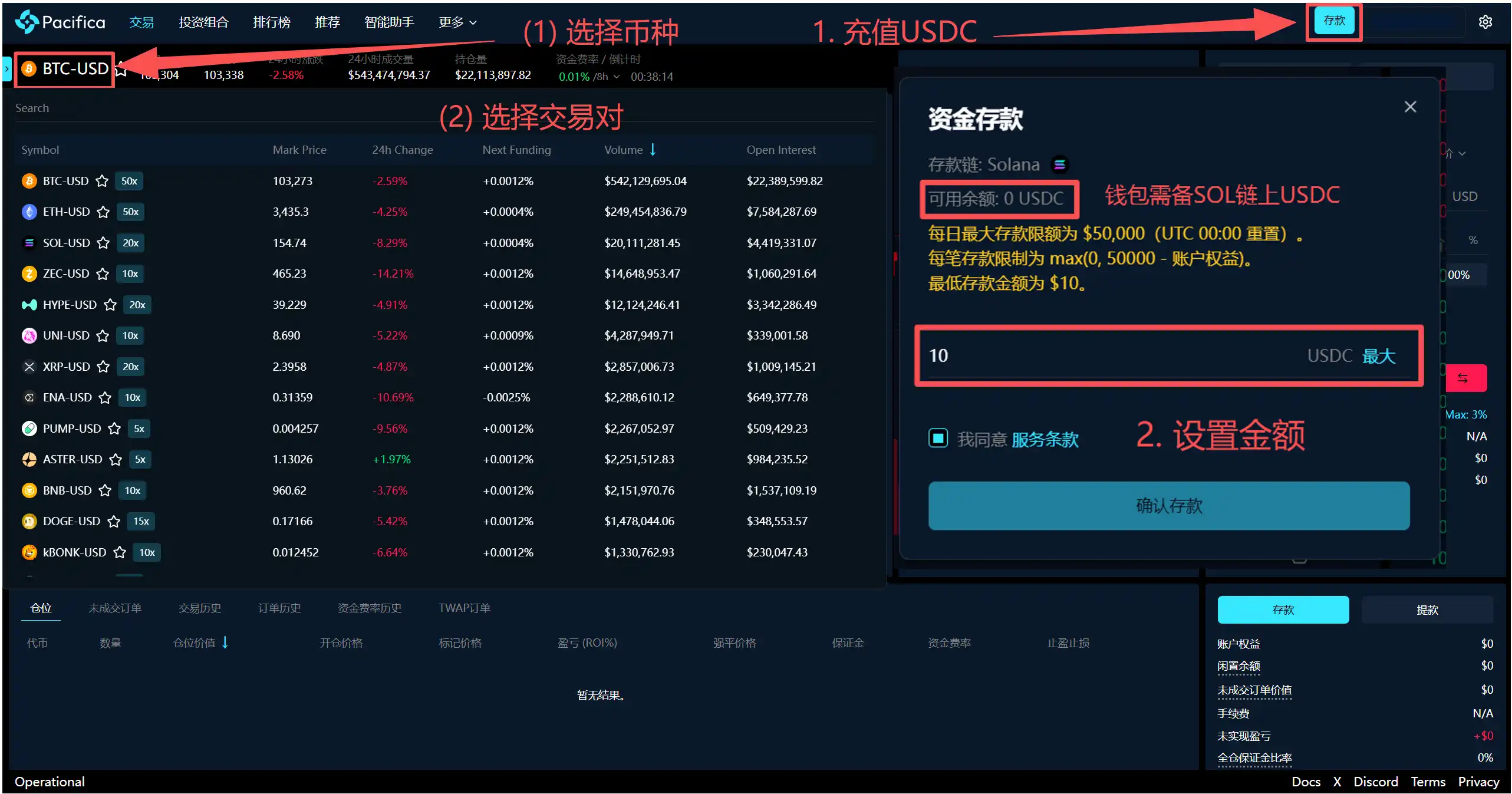

4. Initiate Your First Trade (Using BTC as an Example)

After completing the deposit, you can select the desired trading pair in the top left corner. Currently, Pacifica supports most major tokens and continues to list new tokens.

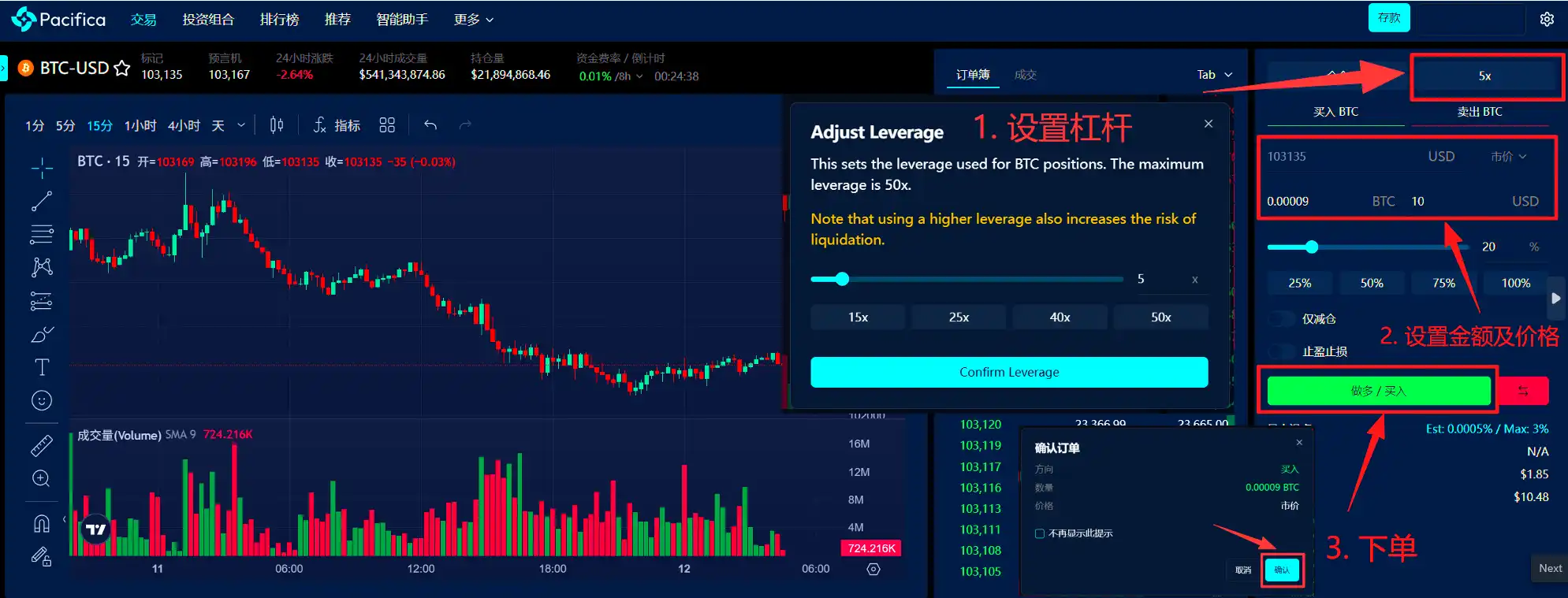

Based on the example in the image:

- Set the leverage ratio (beginners are advised to use low leverage and avoid high leverage)

- Trading direction: Long/Short

- Opening amount/Market order

- Amount of the token to trade

- Click "Confirm" to place the order

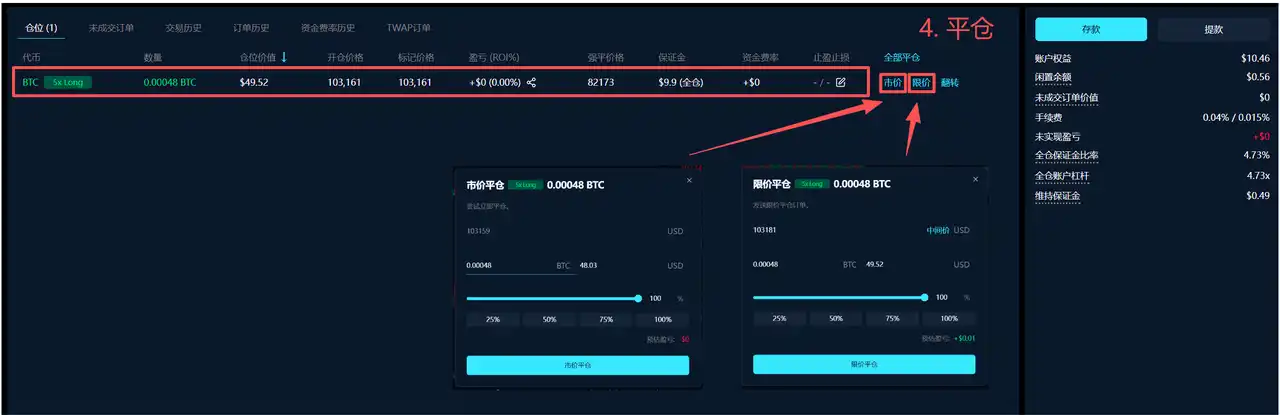

5. After Placing an Order, If You Want to Close the Position or Set a Limit Order to Close, Refer to the Operation in the Figure Below.

Pacifica Points System

The Pacifica points system will launch on September 4, 2025, with a weekly fixed snapshot on Thursdays at 00:00 UTC. Distribution will be completed within 24 hours and will be allocated to eligible active users. The specific distribution formula is not yet public, but it is mostly based on the total platform user trading volume. Currently, 10,000,000 points are distributed weekly to traders (previously 500,000 points, increased by 20 times on October 30). Points are distributed based on the total number of users and trading volumes for the week, so point acquisition is dynamic.

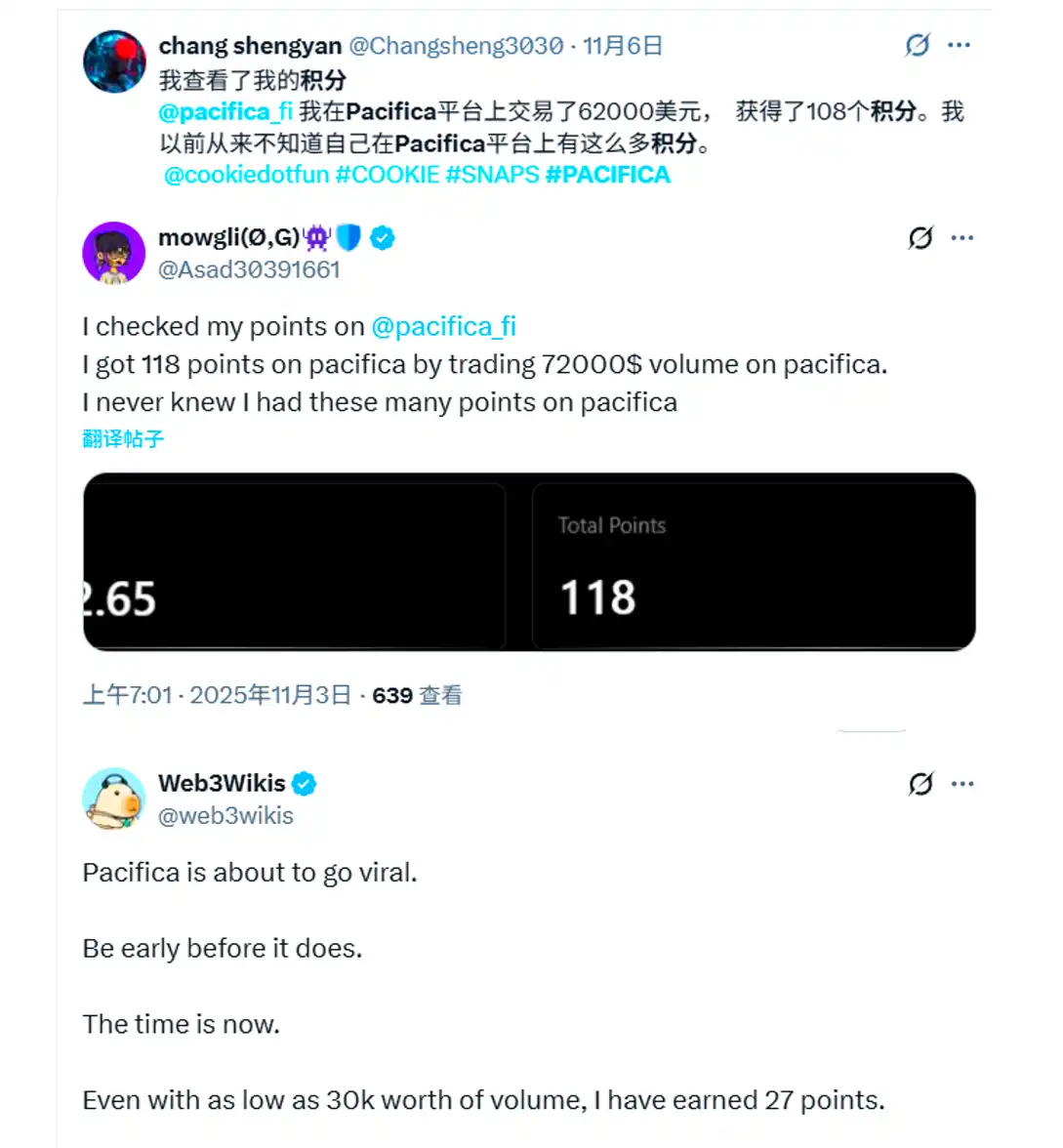

Based on data from multiple traders' feedback online from November to the present, an average trading volume of approximately $600 to $1000 can earn 1 point. Similarly, to reduce wear and tear, traders can choose some tokens with low volatility and low funding rates.

What Is the Value of Points?

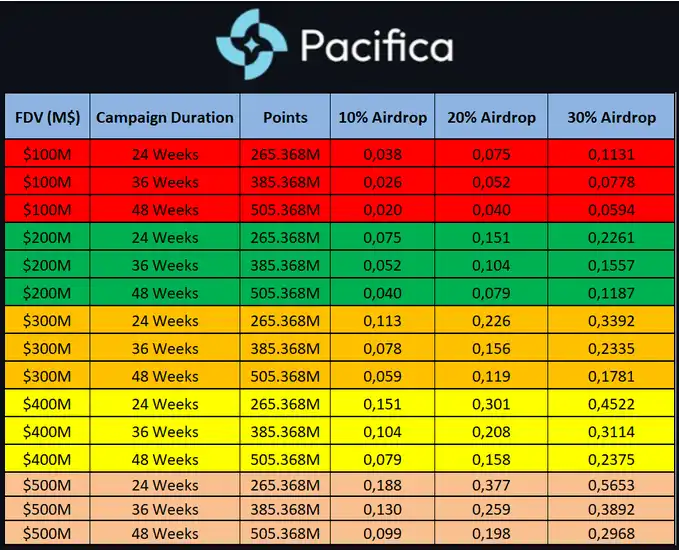

It is important to note that associating the value of Pacifica points with token value is still based on community speculation from industry experience, and the official rules have not been provided. However, based on the typical operations of past projects and community speculation, most people still associate points with tokens. Under this speculative premise, the community has derived a widely circulated valuation logic, with the core formula being: Individual Point Price = (Fully Diluted Valuation FDV of the project × Token Airdrop Ratio) / Total Points Issued in the Points System.

The application of this formula relies on several core variables: one is the estimate of the project's FDV; the second is the assumption of the airdrop as a percentage of the total supply; and the third, which is the most variable, is the prediction of the total distribution period (usually assumed to be 24, 36, or 48 months). The table below will, based on these variables, show different points estimation scenarios for the token price for reference:

Furthermore, a final reminder to everyone, this tutorial aims to help you earn more tokens, as the contract can be confusing, so don't let FOMO take over your actions.

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia