Explain in detail how NFT lending works and the lending platform

Original title: " Explained: NFT Loans and How They Work "

Original author: Bybit

Original compilation: hsl195, dao2

Two aspects of the crypto space are gaining popularity - NFTs and DeFi. NFT, or non-homogeneous token, is a type of encrypted asset that cannot be copied or replaced.

With recent headlines about NFT projects selling for incredible prices, they have become a phenomenon

< /p>

DeFi, or Decentralized Finance, refers to blockchain platforms that provide financial products and services to cryptocurrency investors without the supervision of banks or financial institutions. These platforms enable anyone with an internet connection to borrow, lend or trade crypto assets in minutes without the endorsement of a centralized authority.

DeFi applications are easy to understand in the context of cryptocurrencies like Bitcoin or Ethereum. However, the fact that NFTs cannot be easily traded can confuse some people because they cannot be divided. For example how to get involved? The answer is NFT lending. Valuable NFTs can be used as collateral for loans, just like houses, cars, boats or stocks.

Merging DeFi with NFT opens up a whole new economic model for this emerging crypto asset class. In this guide, we’ll explore how NFT lending works and take a look at the progress some existing platforms are making in the NFT/DeFi space.

What is NFT lending?

NFT lending is provided by DeFi platforms. They allow NFT owners to mortgage their NFT artwork or collectibles in exchange for cryptocurrency or fiat currency. Many NFTs in the market are illiquid, and some DeFi projects have found a growing need to improve NFT liquidity using solutions such as loans.

Non-homogeneous Token (NFT) can represent ownership of a variety of real-world items and digital assets, from virtual real estate and collectible cards, to digital artwork and avatars. The biggest selling point of NFTs is their non-fungibility (non-homogeneity), which basically means that they cannot be divided and cannot be copied.

In contrast, (fungible) cryptocurrencies are divisible, which means that instead of buying a bitcoin in its entirety, investors can Only buy fractions of one at a time. In contrast, all NFTs have a unique digital identifier, ensuring they cannot be copied or split. An original NFT can be easily verified on the blockchain.

Beeple NFT artwork in March 2021 with 69,346,250 in March 2021 The dollar price broke the previous record after the sale. Image credit: Christie's.

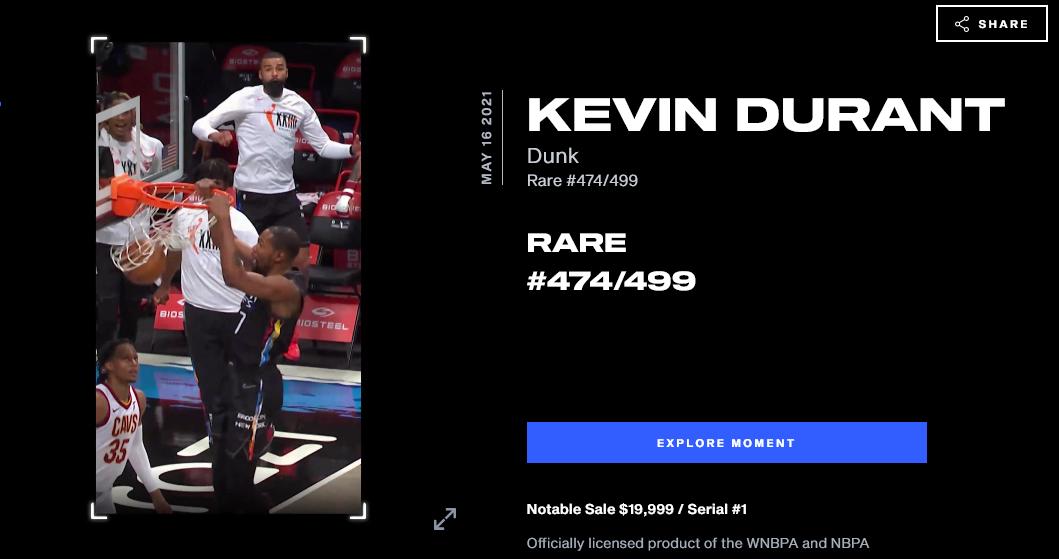

Other examples include Twitter co-founder Jack Dorsey's first tweet, and NBA Top Shot, an NBA-licensed The official marketplace for digital trading cards featuring some of the biggest names in the NBA. Fans can enjoy unique ownership of licensed traded sports cards, as well as sell them for a profit.

The first batch of NFTs featuring clips of Kevin Durant dunking sold for nearly $20,000. Image credit: NBA Top Shot.

However, heterogeneity is not without its flaws. Most notably, it limits what investors can do with their NFTs, making them illiquid. Once an investor has acquired an NFT, the standard option for realizing a profit is to sell it as its value increases.

This is the role of NFT lending, and this mechanism is implemented based on DeFi. NFT-backed lending and fractional NFT ownership via DeFi protocols are emerging as a way to address NFT illiquidity. These innovations create a marketplace where NFT owners can stake their NFTs in exchange for cryptocurrency or fiat.

Once you have purchased an NFT, it is often difficult to use it effectively. Unlike fungible cryptocurrencies, NFTs cannot be staked or otherwise put to work to generate yield. However, NFT-backed lending enables holders to obtain funds using their digital assets as collateral. That loan can then be used to buy more NFTs, buying NFTs that can be converted to fiat Token , or purchase other DeFi protocols that can be deployed to Token , to obtain income.

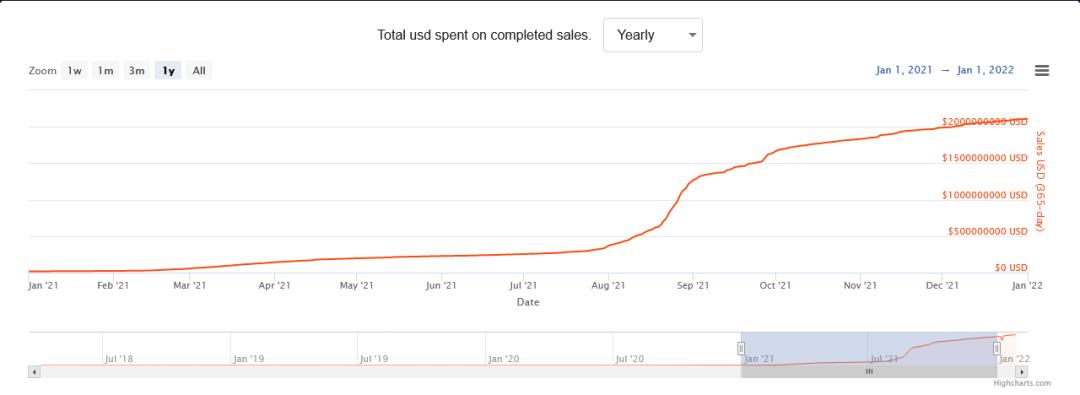

In 2021, sales of NFT artworks will exceed $2.1 billion. Image credit: NonFungible.

DeFi loans are executed by smart contracts, which serve as the basis for transparent, open and self-executing lending solutions that do not require oversight. They perform predetermined tasks, and users can access them through a simple interface, just like any regular application.

However, the smart contracts used by DeFi platforms are not without flaws. For example, flash loan attacks are a common problem with these platforms. Attackers can take advantage of the market when borrowing, making the borrowed Token Plunge in value, then buy back at a low price Token , pay off the loan -- and pocket the difference.

Despite these hurdles, NFT lending is slowly making its mark in the mainstream cryptocurrency market. The NFT ecosystem is currently underdeveloped, perhaps due to its stage of development and market size, but increasing practices in lending, staking, and fractional ownership are driving the industry's continued growth.

How does NFT lending work?

NFT-enabled lending platforms allow holders to borrow funds and set terms without an intermediary. Borrowers can expect to receive a loan line of approximately 50% of the NFT’s value, with interest rates ranging from 20% to 80%, depending on the popularity of the NFT.

The beauty of DeFi protocols is that they are simple, transparent and efficient compared to traditional lending institutions. It doesn’t require a centralized agency to check your credit score, verify your real identity, and spend days or weeks reviewing your application.

DeFi platforms use smart contracts to give users full control over their funds. Assets used as collateral are sent to a secure smart contract, which acts as an impartial, automated third-party process to complete the entire lending process.

The lender assesses the fair value of the collateral, usually by looking at the asset's past performance, sales history, or an NFT-like floor price. A floor price refers to the lowest offer for a particular series of NFTs. Once the terms are agreed upon, the NFT is transferred from the borrower’s wallet to an escrow account, and the loan is facilitated by a smart contract.

In theory, it sounds very simple and crisp, but the market is not completely risk-free. If the borrower cannot repay the loan and interest at the end of the loan period, the lender is entitled to the related NFT. Lenders may also not accept new NFT projects as collateral due to price volatility, as they could end up losing money if the market doesn’t have any demand for defaulted NFTs.

What is NFT fragmentation?

One of the core features of NFTs is that they are completely unique, indivisible and verifiable, guaranteeing absolute ownership. This means that only one owner can fully own an NFT. Fractional ownership of NFTs is a method that allows multiple individuals or parties to own "shares" of NFTs.

NFT owners can use fragmentation to mint Token shard NFT. The price of some NFTs is very high, and fragmentation is a convenient way for several parties to each invest a small amount of money to obtain partial ownership of the asset. An ERC-721 Token The NFT can be split into multiple ERC20 Token , each ERC20 Token It can be sold separately at a more affordable price.

Fragmentation opens up new vistas for the NFT market and brings many benefits, including:

--Enhance mobility. The non-homogeneity of NFT makes it illiquid. For example, investors selling high-priced NFTs may have to wait a long time to attract whales who can afford to buy the asset. Convert an ERC-721 Token Split into multiple ERC20 Token , which can enhance the liquidity of assets and make it easier to find interested investors.

--Price Discovery. As liquidity increases, so does price discovery. One of the biggest benefits of splitting is that it helps investors assess the market value of assets more quickly.

-- Ease of monetization. Fragmented NFTs are easier to find the market. Rather than paying millions for a CryptoPunk or Bored Ape, investors are more likely to pay thousands for a fraction.

Fragmented NFTs have the potential to disrupt the NFT markets for digital artwork, collectibles, game assets, domain names, music, and real estate. In all these areas, NFT creators, artists, and property owners can use fragmentation to quickly sell their assets to a wider market, including small and medium investors.

Best Platform for NFT Loans

The NFT lending market is still in its infancy, but already There are a handful of DeFi platforms that offer opportunities for permissionless lending of NFTs. There are also several upcoming projects, such as those using lending protocol Aave (AAVE), looking to accept NFTs as collateral for loans. Currently, the best platforms for NFT loans are as follows:

NFTfi

Image source: NFTfi

The platform has reportedly raised over $12 million since its launch in June 2020 transaction volume. The average loan size is $26,000 a month, and the platform is said to have facilitated loans of up to $200,000, with a default rate of under 20%.

Arcade

Image source: Arcade .

NFT holders can apply for loans through the Arcade app using one or more of their assets as collateral. Users simply link their MetaMask wallet, then select an asset (from the list of supported collectibles) as collateral, and request a loan on the specified terms.

The platform uses smart contracts to create a wrapped NFT (or wNFT), which represents the borrower's loan collateral, to be used when applying for a loan. The wNFT is locked in an escrow smart contract that records when the principal of funds is sent to the borrower and repaid to the lender. Arcade earns a percentage of every transaction completed on the platform.

Drops

Image source: Drops

Drops is a DeFi lending platform where NFT holders can stake their collectibles as collateral in exchange for instant loans with no middlemen. Users can borrow up to 80% of the asset's value (determined by the floor price) and get instant loans from the lending pool.

Nexo

Image source: Nexo .

Nexo assigns a dedicated account manager to loan applicants. Once an application is approved, the applicant can obtain a loan without the need for a hard credit check or credit history review. NFTs used as collateral will not be liquidated, even if the value of the NFT fluctuates during the loan process.

Bend DAO (translator added)

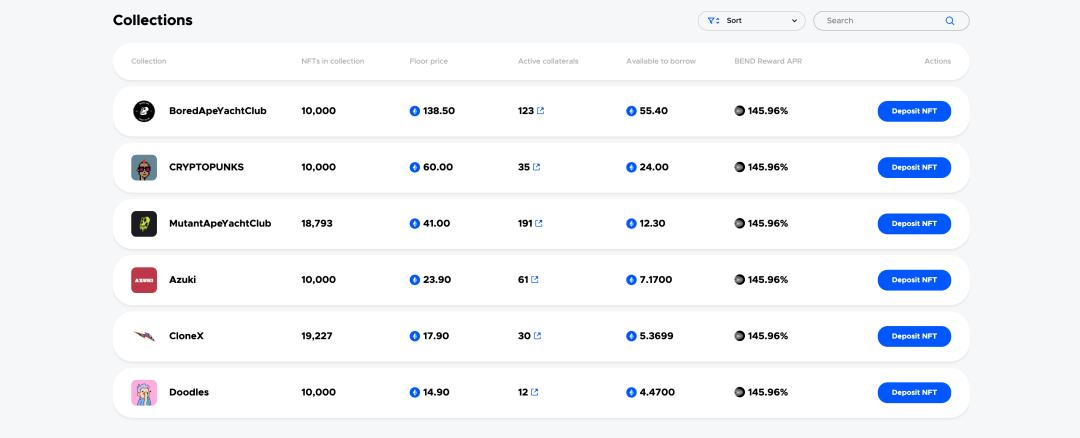

Bend is a decentralized non-custodial NFT lending protocol. Users can participate as depositors or borrowers. Depositors provide ETH liquidity to the lending pool to earn passive income (ETH and BEND, currently at 26% APY), while borrowers are able to instantly borrow ETH (currently at 130% APY) through the lending pool using NFTs as collateral. As can be seen from the APY, Bend is very friendly to borrowers (i.e. NFT stakers), which also contributes to the lending momentum to a certain extent.

Bend is an emerging lending protocol, currently has 123 BAYC, 35 PUNKS, 191 MAYC, 61 Azuki in its lending pool .

Image source: BendDAO

NFT Are loans a good investment?

Recently, the market for NFTs has grown exponentially and is estimated to be a $40 billion market by 2021. Thanks to platforms like Arcade, NFTfi, and Nexo, decentralized NFT lending is opening up new opportunities for the growth of this nascent industry and slowly gaining mainstream attention.

NFT lending is solving the illiquidity problem most digital collectibles face. At the same time, they enable NFT holders to increase the liquidity of their assets, rather than engage in simple strategies of buying and holding.

Even institutional investors seem to be taking an interest in this new market. In December 2021, Arcade announced that it had raised $15 million in Series A funding from investors including Pantera Capital to further develop its platform.

However, these concepts of NFT are not completely beautiful, and there are still many problems to be solved. Besides the environmental impact of NFT minting, one of the other major concerns is high gas fees.

There is a fee to mint NFTs on the Ethereum network, and users pay miners to validate transactions and add them to the blockchain. This sounds simple, but gas fees are volatile, and when the network is congested, fees go up, which is unfair to consumers.

The good news is that Ethereum is actively working on solving this problem, and in 2022 Ethereum will switch to a proof-of-stake model (POS). This change will not only solve Ethereum’s energy consumption and carbon emissions, but also expand the network and increase its transaction processing capacity. This should ease congestion and reduce gas costs.

While no one knows what the next trend in the NFT market will be, it can be said that NFT lending will continue to provide good investment opportunities in 2022 and beyond.

The Opportunity for NFT Lending

NFT Lending is a gateway into the NFT/DeFi space. They have the potential to create exciting revenue streams for previously illiquid assets like NFTs. The core goal of NFT lending is to increase the liquidity of NFTs, providing users with access to capital for use in other projects and services.

To learn more about how lending protocols and blockchain technology continue to evolve, check out our DeFi lending guide.

If you are eager to enter the booming NFT space and want to understand how NFT works, then check out Bybit's NFT marketplace.

About

DAOSquare

DAOSquare originated in the West The famous Ethereum community MetaCartel, DAOSquare's mission is to build an incubator belonging to the Web3 era, so as to better help innovators in this era from 0 to 1 and succeed, just like Y Combinator in the Internet era.

Original text link

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR